As I’m teaching econometrics, I’m adding in handling-of-data issues. Examples from the last three years.

Don’t smear data sources without understanding the data

EJ Antoni: Back to Smearing Data Sources

Don’t argue that the data haven’t exhibited something for a hundred years, when a hundred years of the data don’t exist.

The Availability of Quarterly GDP Data for the US: Memo to EJ Antoni

Don’t assert the data series don’t exist when they do indeed exist:

EJ Antoni: “factor in the millions of people missing from the labor market (don’t have jobs but are excluded from official unemployment calculation)”

Understand what your deflators do — and do not — include before making inferences (tariff pass through edition).

EJ Antoni on the No Tariff Pass Through Thesis

Don’t assert the existence of a vast conspiracy, when simple statistical sampling error could explain results (not that conspiracies don’t exist: just think “Epstein”).

EJ Antoni/Heritage Foundation: “some suspect government statisticians are committing lies of omission.”

Don’t make unsubstantiated assertions that are countered by the bulk of peer reviewed studies.

Heritage Foundation Chief Economist: “Factors such as changes in exchange rates mean that foreign producers typically end up paying some (or most) of a tariff.”

Don’t use month/month growth comparisons when the data are noisy:

Heritage Chief Economist Interprets Biden vs. Trump Employment Trends

When trying to characterize a phenomenon (e.g., inflation), do not rely on one, largely undocumented, data series:

Truflation Chief Economist: “Less Than 1 Percent Inflation? Yes.”

Don’t assert the only definition of a recession is two consecutive quarters of negative GDP growth:

Why Friends Don’t Let Friends Define Recessions as Two Consecutive Quarters of Negative GDP Growth

Report regression statistics (e.g., R-squareds) if you’re going to cite regression results.

EJ Antoni Tries to Estimate Crowding Out using 2SLS

Keep track of what units your variables are measured in, including when running regressions.

Is the Sensitivity of Muni Bond Rates to 10 Year Treasury 0.04?

If you are reporting provocative empirical results, document your data and data series construction.

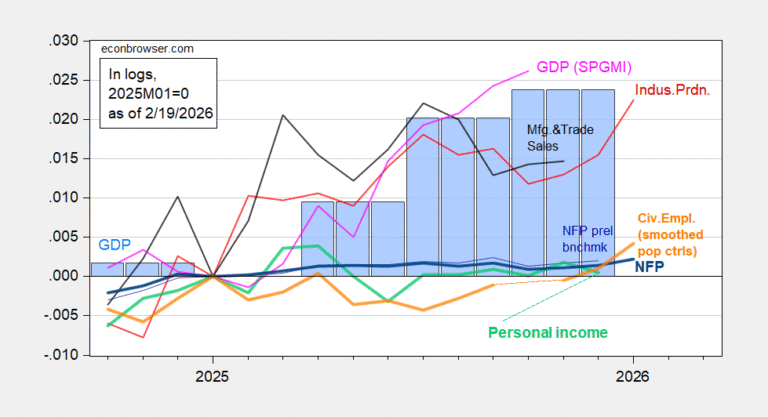

“The Recession of 2025 Will Be Backdated” to 2022

The second edition of rookie economist errors.

Yet more errors:

Don’t dismiss seasonality.

Don’t be casual about estimated trends.

Don’t make policy analysis based on not-statistically-significant parameters.

Don’t forget that just because somebody calls something a “competitiveness index” doesn’t mean it actually measures competitiveness.