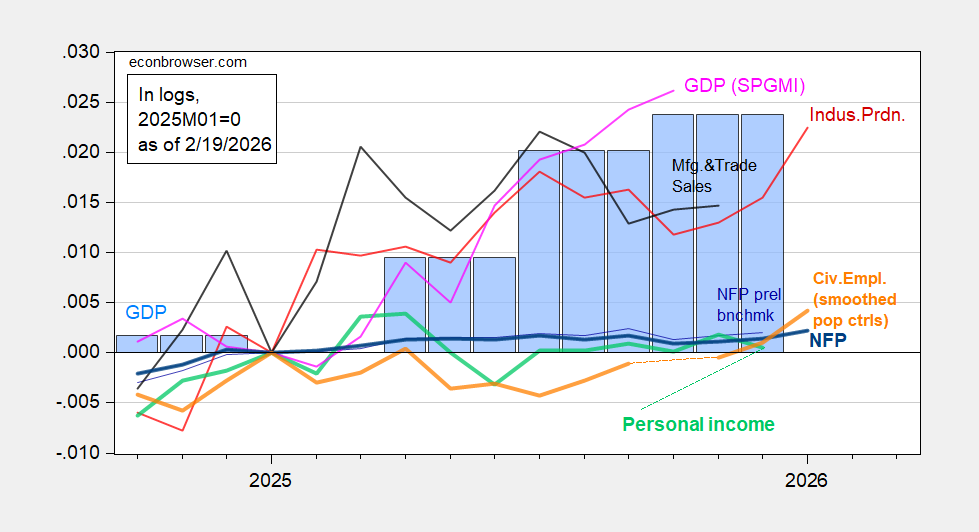

NBER Business Cycle Dating Committee (BCDC) key variables:

Figure 1: Implied NFP preliminary benchmark revision (thin blue), post-benchmark NFP (bold blue), civilian employment with smoothed population controls (bold orange), industrial production (red), personal income excluding current transfers in Ch.2017$ (bold light green), manufacturing and trade sales in Ch.2017$ (black), and monthly GDP in Ch.2017$ (pink),GDP (blue bars), all log normalized to 2025M01=0. Source: BLS via FRED, BLS, Federal Reserve, BEA 2025Q4 advance release,S&P Global Market Insights (nee Macroeconomic Advisers, IHS Markit) (1/21/2026 release), and author’s calculations.

Note that both personal income excluding current transfers and both measures of employment have barely risen from 2025M01 levels (these are variables emphasized by the NBER’s BCDC), while output measures have risen at above trend rates; true GDP only rose 1.4% q/q, but final sales to private domestic purchasers (not shown) continued to grow at 2.4% q/q annualized (see this post).

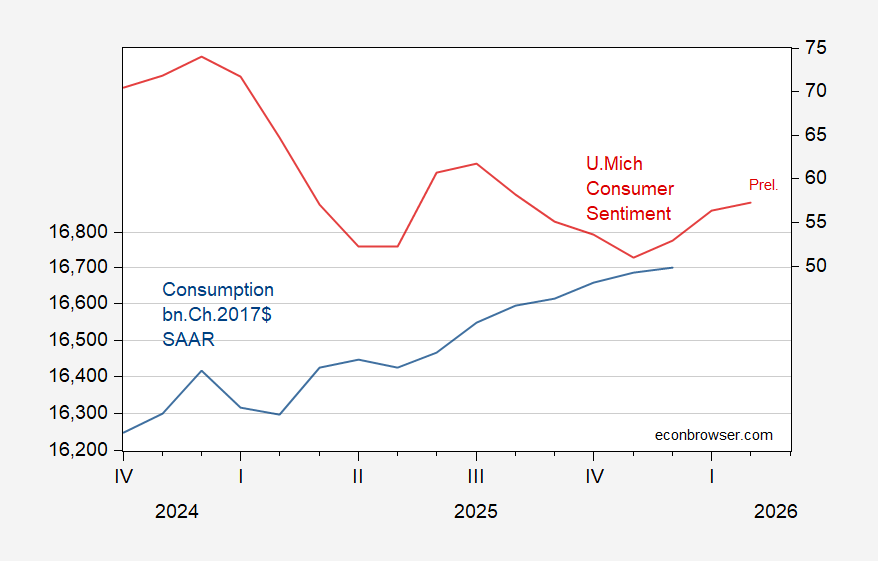

On other counts, note that consumption growth has decelerated.

Figure 2: Consumption, in bn.Ch.2017$ SAAR (blue, left log scale), U.Mich. Consumer Sentiment (red, right scale). Source: BEA, U.Michigan via FRED.

Q/Q consumption growth was 2% in December, down from 4.6% the preceding December.