This is Naked Capitalism fundraising week. 554 donors have already invested in our efforts to combat corruption and predatory conduct, particularly in the financial realm. Please join us and participate via our donation page, which shows how to give via check, credit card, debit card, PayPal, Clover, or Wise. Read about why we’re doing this fundraiser, what we’ve accomplished in the last year, and our current goal, supporting our new Coffee Break/Sunday Movie features

Yves here. It should have occurred to me that venture capital funding and valuations were becoming at least as AI dominated as public stocks. Wolf’s account below is eye-opening.

Equity market crashes don’t produce financial crises unless a lot of purchases are levered. The US and other countries imposed margin lending restrictions after the Great Crash to limit that sort of thing. But stock market meltdowns can produce serious recessions, One cause is those who lost a lot of paper wealth hunkering down and cutting spending. Another is to companies hit by the crash, either due to having underlying business disappear due to the same fictive prospects that propped up the bubble going poof or losing funding. For instance, during the dot com era, many consulting firms, including McKinsey, bulked up in response to the mania, both to advise freaked out old economy companies on what to do, as well as forming an incubator and advising Internet plays in return for equity. McKinsey took over $200 millions in writeoffs, cut its North American staffing by 50% over two years, and was even giving studies away for a bit. So don’t under-estimate how far collateral damage can extend.

By Wolf Richter, editor at Wolf Street. Originally published at Wolf Street

AI startups’ aggregate post-money valuation (the valuation after the latest round of funding) soared to $2.30 trillion, up from $1.69 trillion in 2024, and up from $469 billion in 2020, which back then had already set a huge record, according to PitchBook.

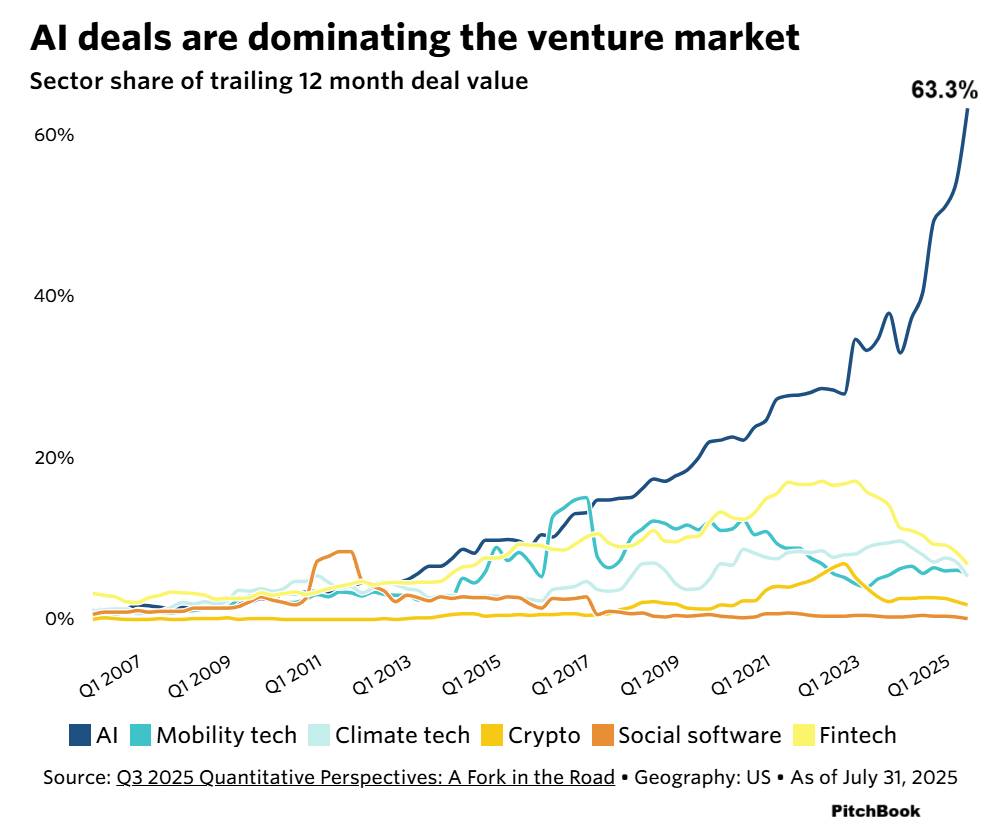

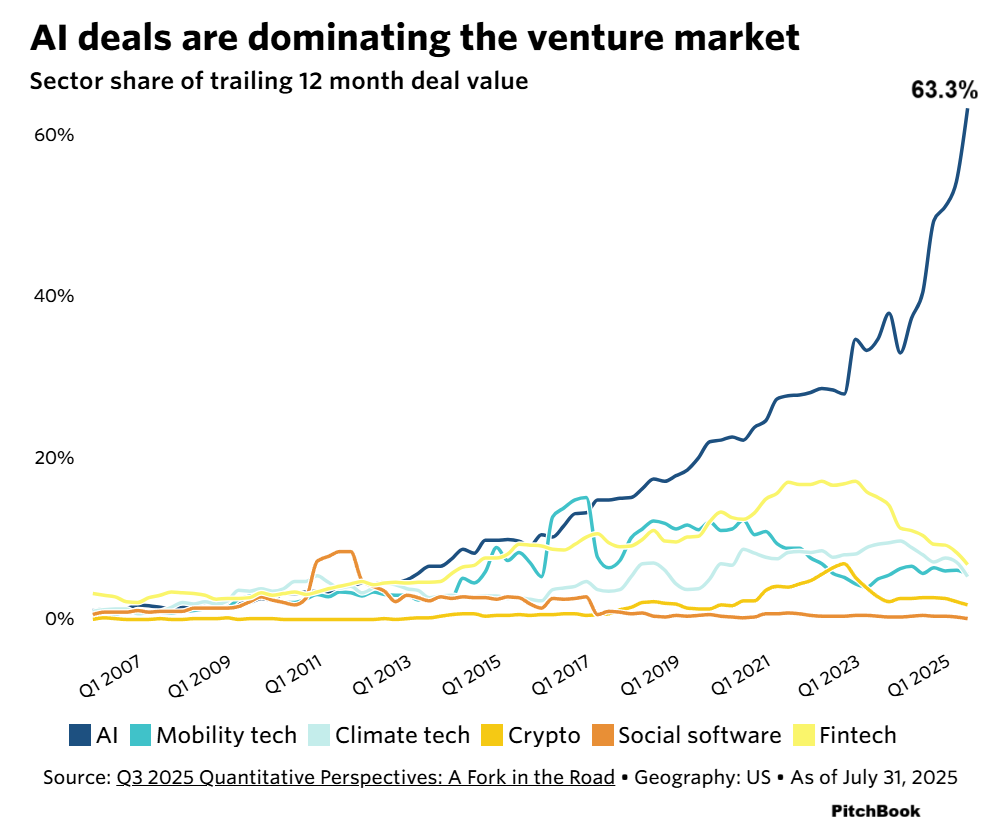

“AI deals have come to dominate the entire venture capital market at an unprecedented clip, dwarfing the quick concentration of investments during prior hype cycles such as crypto and mobility tech,” PitchBook said.

AI startups accounted for 63% of venture capital investments made during the trailing 12 months (TTM), up from 40% over the TTM through Q3 2024, and up from 23% over the TTM through Q3 2020 (blue line in the chart), according to PitchBook’s Q3 2025 Quantitative Perspectives: A Fork in the Road.

OpenAI reached a $500 billion valuation in early September, when it offered eligible former and current employees to sell $10 billion of their shares in a secondary share sale to other investors, led by SoftBank, according to CNBC. In April, OpenAI had reached a breathtaking post-money valuation of $300 billion at a funding round when it raised $40 billion, primarily from SoftBank. The sky is not the limit.

Elon Musk’s xAI is supposedly shooting for a $200 billion valuation in a $10 billion funding round, according to sources cited by CNBC, which Musk denied on X as “fake news. xAI is not raising any capital right now.” Well, not right now. Or whatever.

Anthropic reached a $183 billion post-money valuation, after raising $13 billion in a Series F funding round in early September, according to Anthropic.

And so on. These valuations of AI startups are mind-boggling. How are these late-stage investors going to exit their investments with their skin intact?

These companies would have to go public in huge IPOs with gigantic valuations, and then the shares would have to trade higher from there to allow late-stage investors to sell their shares without tanking the share price.

AI-anything brings in the cash. If 90% implode and take all investor cash with them, and 8% scrape by somehow, but 2% become $1-trillion companies at their IPOs, and are $2 trillion stocks two month later, and are, why not in this bizarro-world, $4-trillion stocks a year later, then it would all work out somehow, that’s kind of how the thinking must be going.

Alas, the biggest AI-anything IPO – and the biggest IPO of 2025 – Figma has caused a lot of heartache. Its shares were priced at $33 at the IPO, popped by 250% on the first day, jumped again on the second day to peak at $142.92, and then plunged by 63% to $51.87 today.

Sure, pre-IPO investors still have enormous gains, but most investors that bought the publicly traded shares are deeply in the red. And if the pre-IPO investors try to sell their remaining huge stakes, they could crush the stock further.

But Figma has a market cap of only $25 billion. AI-company CoreWeave, the second biggest IPO this year, has fared well since the IPO, but it has a market cap of only $68 billion. These are an order of magnitude smaller than what would be needed for late-stage investors to exit their mega-AI companies.

How will these AI companies with mega-valuations of $500 billion now go public at a valuation that is big enough, and then with share prices that rise enough from there, to get the late-stage investors out with their skin intact?

Obviously, we’ve seen over and over again in this immense bubble, that the sky is not the limit and that miracles are being performed on a daily basis. But at these valuations, “exit hurdles become exceptionally large,” PitchBook said.