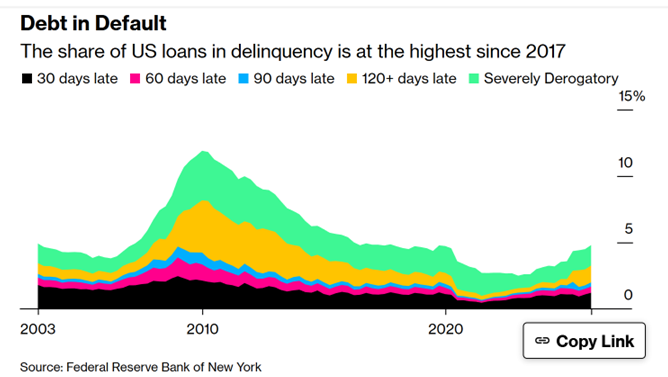

From CNBC:

“I’m clearly in the minority in not being concerned about inflation from tariffs,” he said on CNBC’s “Money Movers.” “But that was also true in 2018-2019, and I think I probably could take a little victory lap about that.”

“There will always be relative price changes, but whether or not it’s inflation that’s macroeconomically significant of the type that monetary policy should respond to is a different question,” he added.

There’s “minority” and “scant few”; I’d classify most independent economists as believing that higher tariffs cause a higher price level.

Here’s mainstream research, summarized and extended by Gita Gopinath (former chief economist and DMD IMF) and Brent Neiman (Deputy Undersecretary Treasury). I think I’ll take a Harvard and U.Chicago economist over Miran’s views.

In 2025, statutory tariff rates on U.S. imports rose to levels not seen in over one hundred years. What are the implications for prices? On the one hand, shipping lags, exemptions, and enforcement gaps have kept the actual implemented rates at only half of the statutory rates, moderating the tariffs’ impact. On the other hand, tariff pass-through to U.S. import prices is almost 100 percent, so the United States is bearing a large share of the costs. We study the incidence of the 2018-2019 and 2025 U.S. tariffs and discuss implications for U.S. sourcing, domestic manufacturing costs, and the dollar.

I will say that the 2025 tariffs are many orders of magnitude larger than those imposed in 2018-19, so one should expect large price level impacts this time around.

Now it’s true that, in theory, imported prices (incl. tariffs) could go up and domestic prices could go down, so that on net the price level stays constant. This could happen for instance if imported goods are neither substitutes nor inputs into domestic goods, and exogenous shocks are “just right”. Still, I must say that seems highly unlikely.

Miran alludes to the CEA study showing import prices are rising more slowly than similar domestic prices.

…pointing to the lack of difference in inflation rates between import-intensive core goods and overall core goods. “If you thought tariffs are driving inflation higher, you’d think imports would be differentially inflating at a higher pace.”

However, since there isn’t a strict concordance between the goods, it’s unclear what to make of the result (one has to remember that if tariffs work as in a textbook, e.g. Chinn-Irwin, then import competing prices and import prices inclusive of tariffs rise in tandem. Throw in imperfect substitutability, market power, etc., well, one could get domestic prices rising faster than corresponding import prices.

I will come back to some big-data based analysis, from Cavallo et al.

![]()

Source: Harvard Pricing Lab, accessed 10 February 2026. Data through 26 January.