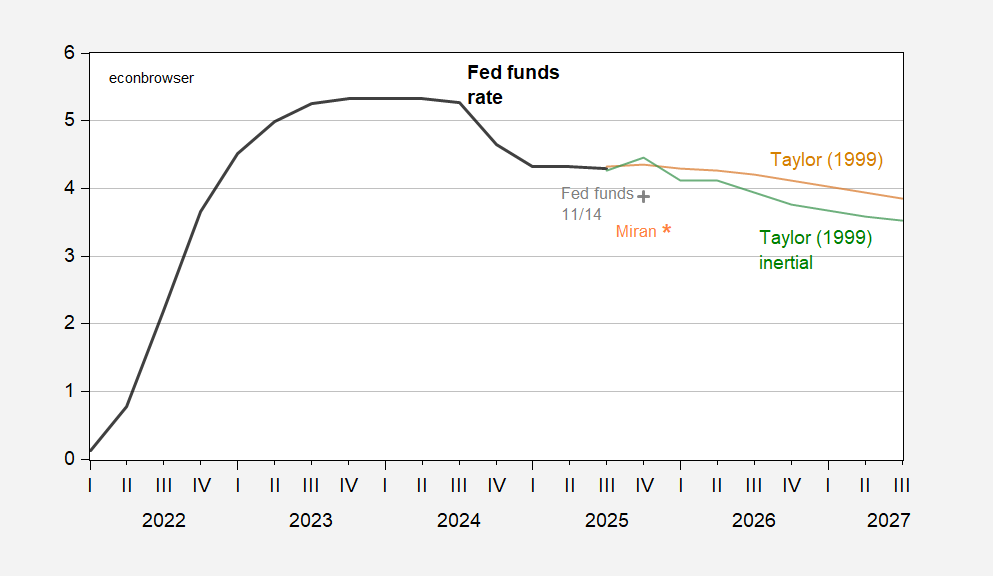

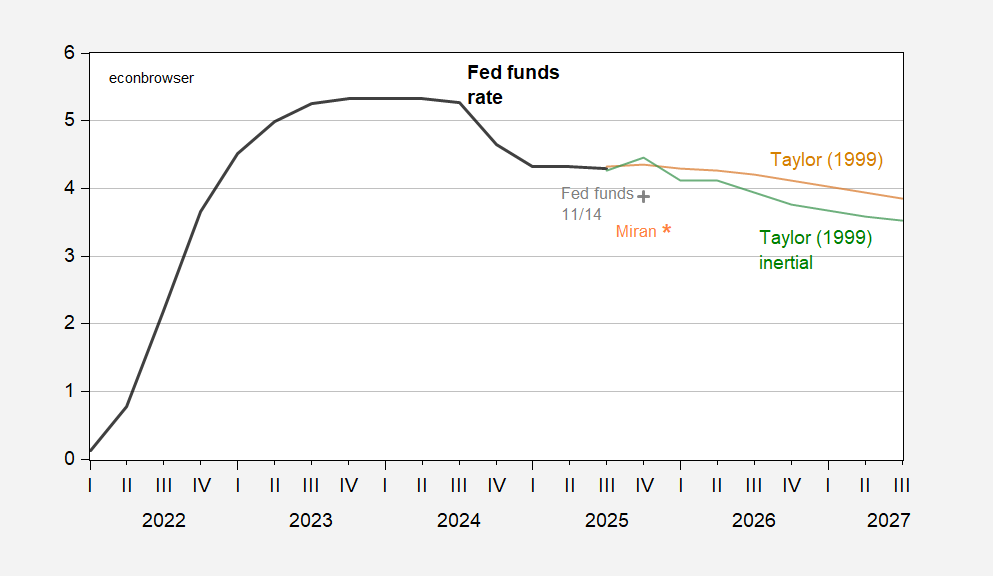

Really, a 50 bps drop in the Fed funds rate in December? What does a Taylor rule say?

Figure 1: Fed funds rate (bold black), Fed funds as of 11/14 (gray +), Taylor (1999) formula (tan), Taylor (1999) formula with inertia (green), Miran’s proposal (orange *), all in %. Uses parameter values and forecasts from Chicago Fed BVAR. Source: Federal Reserve via FRED, Cleveland Fed Taylor rule app.

Using CBO forecasts would result in higher target Fed funds rates.

Now, maybe r* is a lot lower than the 1% assumed in these calculation. Miran has (in my mind unconvingly) argued that r* is low, but has not specified how low.